Traditionally, the blue chip was the most valuable chip at casino tables in the United States. In the 1920s, Oliver Gingold coined the term “blue chip stock” to denote shares selling for at least 200 USD a piece.

Traditionally, the blue chip was the most valuable chip at casino tables in the United States. In the 1920s, Oliver Gingold coined the term “blue chip stock” to denote shares selling for at least 200 USD a piece.

Since stock splitting is commonplace today, the companies currently referred as blue chip stock companies doesn’t necessarily have a share price exceeding 200 USD. Instead, it is more important to be a well-established company with a long string of profitable years to earn the moniker blue-chip. Making big profits in favorable conditions isn’t enough – the company must also have a proven ability to pull through in harsh economic times.

Investing in blue chip stock

Stock investors looking for stability will often turn to blue chip stock. Investing in stocks is never without risk, but blue chip stocks tend to be low risk when it comes to volatility. Blue chip stocks are popular long-term investments, since these companies tend to survive even when the general economy is doing poorly. Some blue chip stock companies even thrive in this type of though economic climate.

Another factor that makes blue chip companies attractive for long-term investors is that many of them have a solid record of yearly dividend payments. For the shareholder, receiving dividends means getting a stream of revenue from the investment while still owning it. With non-dividend paying shares, the main method of making a profit is to buy shares, wait for the share price to go up, and then sell the shares to pocket the difference between purchase price and sell price. If you are making long-term investments, you aren’t interested in selling off your shares just because the price has gone up a bit. You plan for your invested money to be locked-in for a long time, and receiving dividend payments is a nice way of getting some revenue out of the investment during this long period of continuous ownership.

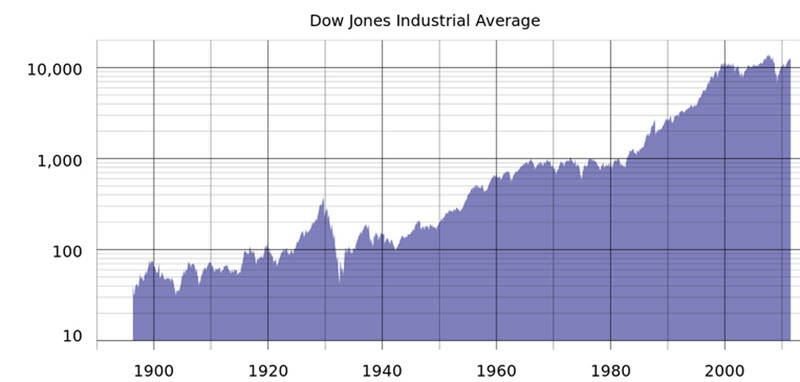

DJIA – a good place to start

If you are looking for stocks that come with the blue chip characteristics listed above, the Dow Jones Industrial Average index is a good place to start. There is absolutely no guarantee that every stock included in this index will be blue chip material, but it is a good place to start your research if you are feeling a bit overwhelmed by the abundance of available stocks.

It should be noted that the Dow Jones Industrial Average included only U.S. stock companies. If you are looking for blue chip companies based in other jurisdictions, there are other indices that provide a good starting point for your research, such as the FTSE 100, FT 30, DAX, MDAX and S&P/TSX Composite Index.

About DJIA

The Dow Jones Industrial Average (DJIA) index follows a select group of U.S. stock companies widely regarded as blue chip companies. Each company included in the index is a giant within its field.

Once upon a time, the industrial part of the name of this index was important, but today it is largely there for historical reasons. The original intention of the index was to focus on heavy industry, but this aspect is no longer important when companies are selected for the index. The index does for instance currently include companies such as JP Morgan Chase and Walt Disney.

DIJA components – maybe one of these will be your next blue chip purchase?

The oldies

Some companies on the current Dow Jones Industrial Average index were added during the first half of the 20th century and has thus prove to be supremely long-lasting enterprises. General Electric (NYSE:GE) was added on November 7, 1907. Another one of these oldies is ExxonMobil (NYSE:XOM), a company previously know as Standard Oil of New Jersey. Standard Oil of New Jersey entered the DJIA on October 1, 1928.

Chemical industry giant DuPont (NYSE:DD) first entered DJIA in January 1924, but only remained in the index until the end of August the following year. Ten years later – on November 20, 1935 – DuPont was brought back to DJIA and has remained there ever since.

Two other examples of companies that’s been continuously included in DJIA since the 1930s are Procter & Gamble (NYSE:PG) and United Technologies (NYSE: UTX). Procter & Gambler was added in 1932, United Technologies in 1939 (as United Aircraft).

IBM (NYSE:IBM) is typically seen as a company typical of the computerized era of the late 20th century, but did you know that this is actually a fairly old corporation that made it’s very first appearance in the DJIA back in 1932? IBM was one of the index’s constituents from 1932-05-26 to 1939-03-04. IBM was then reintroduced in 1979 and has stayed in the DJIA index ever since.

1970s

A majority of the companies that currently comprise the DIJA were added after 1975. Among the ones added in the 1970s, we find 3M (NYSE:MMM) and the large pharmaceutical company Merck (MYSE:MRK). When MMM was added back in 1976, it was under it’s original name: Minnesota Mining and Manufactoring.

1980s

Among the companies added in the 1980s, we find several belonging to the consumer goods sector, such as American Express (NYSE:AXP), McDonald’s (NYSE:MCD) and Coca Cola (NYSE:KO). For Coca Cola, this was its second appearance in the DIJA index – the first time Coca Cola was a part of the index was between 1932-05-26 and 1935-11-20. Coca Cola was added for the second time on March 12, 1987. On that same date, aerospace and defense company Boeing was added as well.

1990s

Examples of companies added in the 1990s are well-known households brands such as Walt Disney (NYSE:DIS), Wal-Mart (NYSE:WMT), Caterpillar (NYSE:CAT), Johnson & Johnson (NYSE:JNJ), and The Home Depot (NYSE:HD). Under its old name, what is nowadays known as J.P. Morgan & Co was added in 1991. This is the largest bank in the United States by total assets.

In the late 1999s, something revolutionary happened with the DJIA. On 1 November, Intel and Microsoft were added to the index – two companies listed on NASDAQ and not on NYSE.

2000s

Chevron (NYSE:CVX) had been removed from the DJIA index on 1 November 1999, after being present since 1930! In the 2000s, Chevron made a celebrated return to DJIA and has now been included there since February 2008.

Examples of other companies added to the DJIA index in the 2000s are Pfizer (NYSE:PFE), Verizon (NYSE:VZ), Cisco Systems (NASDAQ:CSCO) and Travelers (NYSE:TRV).

2010s

If you want to invest is some of the most recent additions to the Dow Jones Industrial Average, there are several companies to chose among and they are spread out over several industries. If you’re interested in investing in the banking sector, take a look at Goldman Sachs (NYSE:GS) and Visa (NYSE:V). If you’re more interested in the consumer goods sector, there’s Nike (NYSE:NKE) added in 2013 and Apple (NASDAQ:AAPL) added in 2015. Another interesting option among the recently added companies is UnitedHealth Group (NYSE: UNH), a company active in the rapidly growing and expanding health care industry.

This article was last updated on: December 21, 2016